CODA

We Build & Scale Brands Investors Bet On

Ideation → Exit

CODA drives valuation, market perception, and investor confidence.

$3B+

Portfolio Value

$50M+

Secured Capital

$200M+

Revenue Generated

$500M+

Valuation Uplift

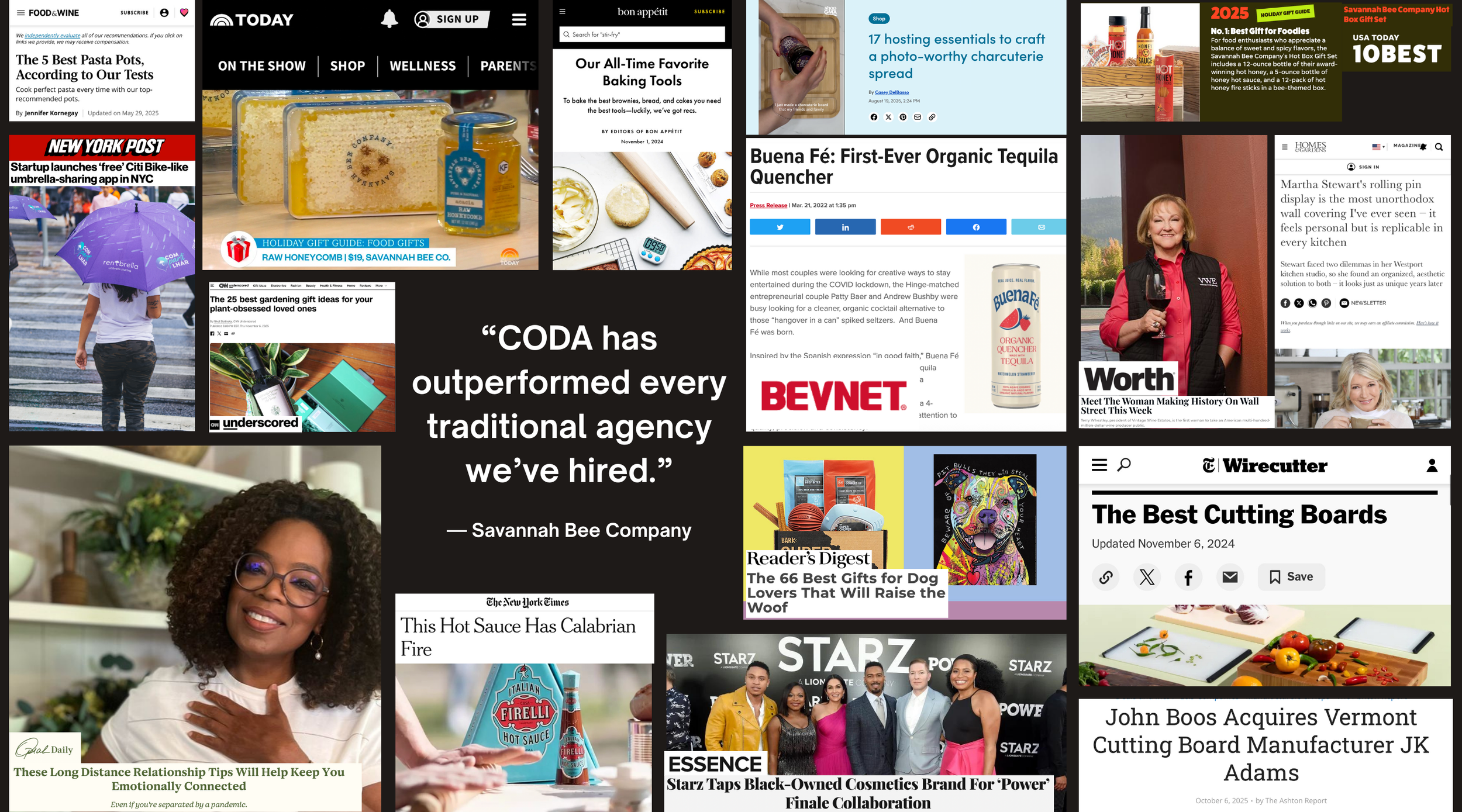

Experience & Brand Track Record

Our work spans venture-backed startups, emerging consumer brands, and industry-leading global companies.

Building brands is our Genius. Leading your brand is yours.

What We Do

-

From idea to investor-ready.

We partner with first-time founders and early-stage companies to build a backable, investor-approved foundation.What this includes:

Business & Investment Narrative Architecture

We uncover the full story behind the business — market opportunity, differentiation, traction, financial pathing, and competitive landscape — and translate it into a backable, investor-aligned business plan.Pitch Deck Content Development

We provide all narrative content, messaging, and strategic framing required for a compelling pitch deck (your design team or ours can handle visuals).Pitch Coaching & Delivery Prep

Whether you're preparing for pitch competitions or direct VC meetings, we coach you through delivery, Q&A, positioning, and investor objections with a focus on confidence and clarity.Capital Partner Introductions

Based on your stage, category, and vision, we facilitate curated introductions to investors, strategic partners, or capital groups aligned with your long-term goals.Live Presentation Support

We sit in on key investor calls and presentations, gather real-time feedback, and refine your positioning for subsequent conversations.Round Support Until Close

We continue coaching, refining, and facilitating introductions until your capital round is successfully closed.

-

Refine the strategy. Align the stakeholders. Accelerate the path forward.

For funded, fast-moving companies juggling growth, investor expectations, and internal complexity, we provide high-level strategic refinement and operational clarity.What this includes:

90-Day Strategic Audit & Refinement

We evaluate your existing strategy, go-to-market plan, messaging, operations, and investor materials to understand what’s working, what’s missing, and what’s holding you back.Critical Improvements & Strategic Additions

We refine the components that need strengthening, identify gaps that must be addressed, and present what should be added, evolved, or removed to support sustainable scale.Stakeholder & Investor Alignment

We meet with your current investors, advisors, and internal leadership to ensure everyone is aligned around the same narrative, expectations, and growth plan.Decision-Making & Clarity Frameworks

We help leadership streamline decision-making, reduce noise from competing opinions, and anchor the company in a strategic direction that supports both vision and execution.Transition to Long-Term Advisory

After the 90-day engagement, we shift into an advisory role to guide implementation, provide strategic oversight, and support leadership as the company grows.

-

Strategic oversight for post-Series A/B companies preparing for acquisition.

For growth-stage companies already backed by institutional investors and moving toward M&A, we provide high-level strategic support to ensure the business is aligned, performing, and positioned correctly through the exit process.What this includes:

Exit Readiness & Value Narrative

We assess the company’s brand, financial trajectory, and operational structure to identify the milestones, messaging, and positioning required to maximize valuation during acquisition.Due Diligence Preparation & Guidance

We help leadership organize, refine, and present the information buyers and bankers expect—reducing friction, tightening narratives, and ensuring consistent alignment across teams.Strategic Oversight Through the M&A Timeline

We work alongside founders, leadership teams, and current investors to ensure strategic focus, operational stability, and cohesive messaging throughout negotiations and buyer conversations.Stakeholder & Investor Alignment

We facilitate clarity across existing investors, board members, and key executives to maintain a unified direction during a period where misalignment can stall or compromise the deal.Performance Communication & Positioning

We support the company in presenting milestones, updates, and achievements in a way that strengthens the acquisition narrative and builds buyer confidence as the process unfolds.Hands-On Advisory Until Close

We remain engaged throughout the exit process, offering experienced strategic counsel as you navigate buyer feedback, negotiations, and final terms—ensuring nothing jeopardizes momentum.

Our four-pillar system applies to ALL clients (early-stage and scaling)

Dream → Build → Grow → Sell

Our Framework

Pillar 1

Clarity & Diagnostic

Deep-dive founder and leadership interviews

Brand, financial, and operational assessment

Category, competitive, and valuation analysis

Identification of barriers to investment or scale

Alignment on strategic narrative and business logic

Pillar 2

Brand Architecture

Strategic narrative development

Messaging hierarchy and communications architecture

Category design and market positioning

Audience and buyer psychology validation

Story alignment with valuation and growth

Pillar 3

Market Traction

Traction pathway design (press, partnerships, distribution)

Momentum-building visibility moments

Credibility markers (reviews, partnerships, authority content)

Market proof or “proxy traction” based on stage

GTM, pricing, and offer refinement

Pillar 4

Capital or Exit Pathway

Investor readiness + pitch refinement

Financial clarity and valuation logic alignment

Stakeholder and board alignment

Investor meeting preparation and support

Capital introductions (where applicable)

Exit pathway structuring for Series A+ companies

Who We Work With

Founders who are building, scaling, or preparing for exit.

Consumer & CPG

Tech & Tech-Enabled

Food, Beverage & Hospitality

Results

Contact Us

Ready to work together? Tell us a little about your business, and we’ll be in touch soon. We look forward to connecting with you!